California offers residents and businesses clean energy incentives to install solar panels and invest in clean energy vehicles.

In combination with federal tax credits for green energy, the cost of any new equipment installed can qualify.**

TAX INCENTIVE NOTICE*

**Fraud Alert**

US Green Energy

Click Here to Sign Up for Free Solar Panel Installation

| Schedule | Acceptance Date | Last Day To Register |

|---|---|---|

| Q1 | Monday January 1, 2024 | March 30, 2024 |

| Q2 | Monday April 1, 2024 | June 30, 2024 |

| Q3 | Monday July 1, 2024 | September 30, 2024 |

| Q4 | Tuesday October 1, 2024 | December 30, 2024 |

| Q1 (2025) | Wednesday January 1, 2025 | March 30, 2025 |

California Virtual Net Energy Metering

Clean Vehicle Rebate Project

PLEASE NOTE: Beginning in 2025, the federal tax incentives for solar residential installation will be impacted. See the table below for the dates and amounts currently legislated.**The Federal tax credit is available every year that new equipment is installed.

California Government

10th and L Streets

Sacramento, CA 95814

(916) 324-0333

Hours: M-F 8:00am – 5:00pm

Pacific Gas and Electric Company

300 Lakeside Drive, Suite 210

Oakland, CA 94612

(877) 660-6789

Hours: M-F 7:00am – 7:00pm

Sat 8:00am – 5pm

Energy Division

California Energy Commission

715 P Street

Sacramento, CA 95814

(800) 555-7794

[email protected]

[email protected]

Hours: M-F 8:00am – 5:00pm

Los Angeles Weather Bureau

8400 Remount Road

520 North Elevar Street

Oxnard, CA 93030

(805) 988-6610

[email protected]

Hours: Open Daily, 24 hours

Clean Energy and Vehicle Federal Tax Credits

Business Federal Tax Credits

State Tax Credit and Rebate Schedule

| Year | Credit Percentage | Availability |

|---|---|---|

| 2024-2032 | 30% | Individuals who install equipment during the tax year |

| 2033 | 26% | Individuals who install equipment during the tax year |

| 2034 | 22% | Individuals who install equipment during the tax year |

| Home Efficiency Rebates (HOMES) Program | Project funding or performance-based rebates | Enhanced rebate value for eligible low-income households |

| Heat Pump Water Heater Rebates | Up to $2,000 | For eligible heat pump water heaters |

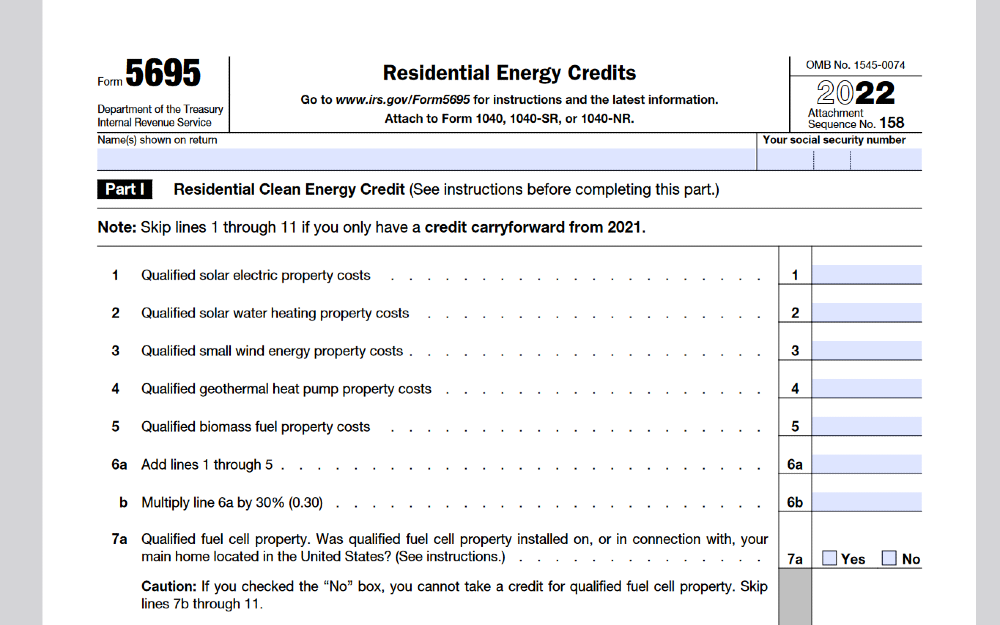

If you have determined that you are eligible for the green energy credit, complete Form 5695 and attach to your federal tax return (Form 1040 or Form 1040NR).

IRS Form 5695

Instructions

Future Due Dates and Basics

Office of Energy Efficiency & Renewable Energy

Forrestal Building

1000 Independence Avenue, SW

Washington, DC 20585

RESIDENTIAL CLEAN ENERGY TAX CREDIT

California Clean Energy

Desert Renewable Energy Conservation Plan

Energy Innovation Ecosystem

Renewable Energy for Agriculture Program

Power Outage Maps

Home Energy Rating System Program – HERS

California Automated Permit Processing Program – CalAPP

Renewables Portfolio Standard – RPS

Contact

California Office of Sustainability

707 Third Street, Fifth Floor

West Sacramento, CA 95605

(916) 375-4671

[email protected]

California Solar Overview

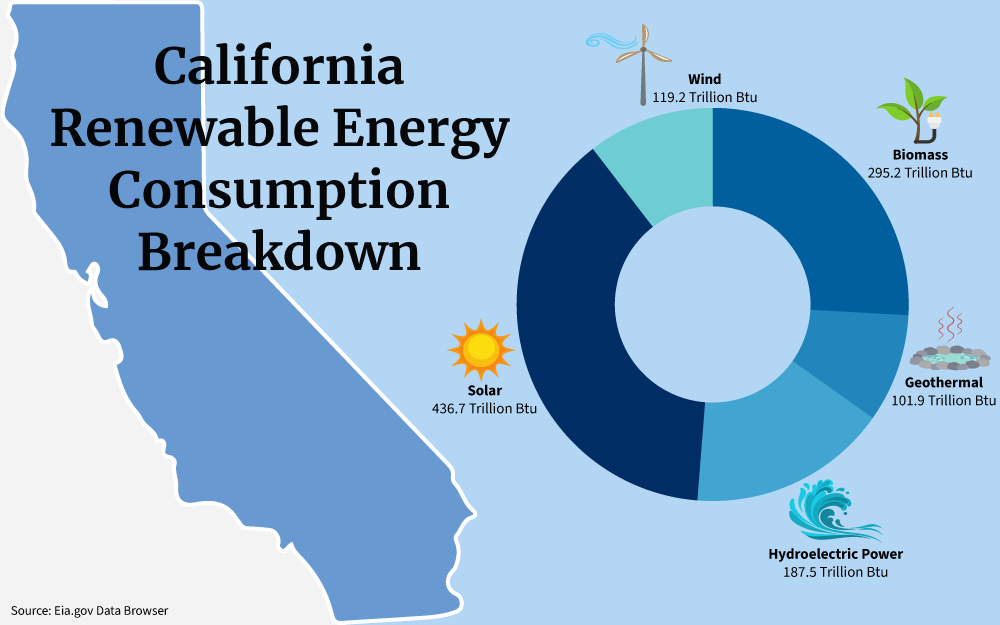

California is known for sunshine and coastlines, but finding and implementing renewable energy in the state is a crucial part of the government’s mission and has led to a plethora of California solar incentives.

The goal of 100 percent renewable energy by 2040 has spurred a number of state-wide rebates, credits, and programs that allow residents in the state to install home solar systems and reduce their household energy emissions.

Anyone may register for these programs, qualifying to have a portion of their solar panel cost mitigated, and the state’s ranks number one in the nation for solar adoption.

As solar panels become more practical, they are an effective tool for gaining energy independence and lowering monthly electricity costs.

California Solar Programs Explained

With solar incentives, California is helping the entire country reduce its dependence on fossil fuels to power electric vehicles and homes, using California solar programs like:

- State Solar Tax Credits

- Federal Tax Credits

- Energy Efficient Renewable Energy (EERE) Programs and Funding Opportunities1

- Rebates on Solar Home Installations

- Power Purchasing and Net Metering Agreements

- Additional Green Credits and Rebates

This guide explains how to use California solar incentives, and in particular, the California Solar Initiative to lower your electricity expenses and provide green power for homes and businesses throughout the state.

Solar Tax Credits for California Residents (EERE Funding and More)

Leading the nation in making solar panels an affordable option for home energy use, California has incentivized installing home solar energy systems using the California Solar Initiative, which has been discontinued. However, it paved the way for the current programs that go above and beyond what is currently offered by the federal government.2

Issued by the (CPUD) California Public Utilities Commission, solar guidelines and programs are conducted.

These additional incentives, when used in conjunction with the former Federal Solar Incentives Tax Credit (ITC), now named the Federal Tax Credit for Solar Photovoltaics, serve to reduce the up-front installation costs of solar panels in the state.

The following list of incentives can be used by residents in California who qualify for the relief.

Single-Family Solar Homes (DAC-SASH)

The DAC-SASH provides open enrollment to families and customers who meet income level requirements, allowing them to obtain solar energy systems installed on their roofs.

To register for this free solar panel program in California, the following conditions are required:

Families (single families) must live in a registered Disadvantaged Community (DAC) as outlined by the state.3

Homeowners are also eligible for the state’s electricity reduction programs (for low-income families who obtain discounted electricity rates).

Homeowners who are approved may install from 1-5 kW solar panel systems, at a rate of $3.00 per watt.

The program is budgeted only through the year 2030, so taking advantage of open enrollment now is advised.

The state’s GRID alternative website has the information and links to apply for this California solar rebate.4

Disadvantaged Communities Green Tariff (DAC-GT)

This California solar incentive is designed to assist residents who meet the criteria above (California Alternate Rates for Energy (CARE) and DAC, as well as the Family Electric Rate Assistance (FERA) and are not able to install their own solar panels.5, 6

Its capacity metrics are outlined in this document, and the project size is considerably larger, 500 kW to 20 megawatts (MW).7

Community Solar Green Tariff (CSGT)

The CSGT program also helps members of DAC areas and residents obtain all of their power from renewable energy, but the project extends the scope, including areas in the San Joaquin Valley and beyond.

These pilot communities act as tentacles, providing power to customers within 40 miles of the proximity. This 20 percent discount program benefits residents who qualify for the incentives above and who are looking for solar panels for home installation.

Self-Generation Incentive Program (SGIP)

This California solar incentive was just authorized an additional $1 billion through the year 2024 and provides residents with the resources to install solar energy storage.

This increase is designed to target communities that have experienced recent public safety power shut off, due to wildfires and other issues.

Open enrollment is ongoing for this solar incentive, and “equity” defined programs make the storage systems nearly completely free of cost to California residents.

To apply, residents must be customers of participating utility providers, use the online tool to find an installer, and contract, having the installer perform the rebate paperwork.

For example, some people can obtain 10-15 kWh of stored electricity (in an approved battery, like a Tesla Powerwall), and obtain a 50-100% cash-back rebate.

All the resources, including qualifications and locating an installer, are found on the state website.8

California’s Demand Side Grid Support Programs

Like the SGIP, these types of ‘demand side’ programs have been implemented to help reduce rolling power outages throughout the state and provide incentives to customers who help reduce the load on the state’s power grid, using a number of conditions.9

Questions about which providers participate (and if your utility provider does) can be directed to:

- Reliability Incentives Office

- Demand Side Grid Support Program

- [email protected]

Or, you can enroll using the dedicated website set up for participants.10

Solar Tax Credit Issued by the Federal Government

The federal government has issued income tax credits for taxpayers who install solar panels on their homes, sheds, and other properties, to provide energy to themselves or the main grid.

This credit is called the Solar Incentive Tax Credit (ITC) and can pay for up to 30 percent of the cost of establishing a home solar energy system.

Any taxpayer in California who installs solar panels is able to apply, using the Internal Revenue Service (IRS) tax Form 5695.

The credit covers the costs of items including:

- Solar Panels

- Batteries and Storage Materials

- Installation Hardware (such as inverters and other mechanisms required for the operation of the panels)

Moreover, in some cases, the ITC can be used to cover the costs of roof upgrades and mounting materials needed for the solar panels.

For individuals in California who do not qualify for DAC solar assistance, this 30 percent tax credit can provide a significant reduction in the upfront costs of home solar installation.

Area Specific Solar Exemptions, Stipends, Discounts and Rebates

California’s solar incentives encompass the entire site, but many communities have gone even further, providing rebates, discounts, tax exemptions and stipends for using residential solar for your energy needs.

One such area is provided by the Rancho Mirage Energy Authority (RMEA).11 Residents who establish a home solar system there, and who have the system inspected by RMEA are able to recoup $500 of the cost using a rebate designed to cover fees and costs associated with the approval and installation.

The Sacramento Municipal Utility District offers voluntary programs that can deliver up to $2500 in rebates.12

SolCalGas ENERGY STAR Solar Thermal Water Heating System Rebates

Many other renewable energy programs and rebates are available for customers of SolCalGas, including:

| Appliance | Rebate | Conditions |

| Energy Star Certified Solar Thermal Systems with a gas water heater backup | $2,500-$4,500 | 1.8 SUEF or above |

| ENERGY STAR Solar Thermal Water Heating System with an ENERGY STAR Tankless Gas Backup replacing a Tankless Gas Water Heater | $4,500 | .95 UEF or above |

| ENERGY STAR Solar Thermal Water Heating System with an ENERGY STAR Tankless Gas Backup (.95 UEF or above) replacing a Storage Gas Water Heater | $4,500 | .95 UEF or above |

| ENERGY STAR Solar Thermal Water Heating System with an ENERGY STAR Storage Gas Backup replacing a Storage Gas Water Heater | $3,500 | Up to 55 gallons |

| ENERGY STAR Solar Thermal Water Heating System with a NON-ENERGY STAR Tankless Gas Backup replacing a Tankless Gas Water Heater | $3,000 | .82 UEF or above |

| ENERGY STAR Solar Thermal Water Heating System with a NON-ENERGY STAR Tankless Gas Backup replacing a Storage Gas Water Heater | $3,000 | .82 UEF or above |

| ENERGY STAR Solar Thermal Water Heating System with a NON-ENERGY STAR Storage Gas Water Heater backup replacing a Storage Gas Water Heater | $2,500 | up to 55 gallons |

There are a number of requirements that you need to take note of to avail the rebates offered by SolCalGas, which can be found on their website.

California Solar System Property Rights and Tax Exemptions (Easement)

When you install a residential solar energy system, including energy storage, the value of your home increases, which typically increases your property taxes.

In California, however, there is an active solar energy tax exemption, which is approved until 2025. This means that although the value of your property will increase, the taxes assessed on it will not. This California solar tax exemption is a great way to reduce costs.

Likewise, Homeowner’s associations are not allowed to deny the installation of solar panels for energy use but do have the ability to include restrictions.

Customer-Sited Renewable Energy Generation Options in CA

In addition to the incentives above, California offers more resources, programs, and equity options for residents who opt for renewable energy.

Net Energy Metering and Net Billing

Net energy metering (NEM) and Net Billing tariffs (NBT) allow residents and customers to provide power to the state’s grids, in excess of what they use.

For example, if a homeowner has a solar or wind generation system connected to a grid provider, the additional wattage that is generated is bought by the provider, usually at a rate of two to three cents per kWh when bet metering is employed. However, NBT allows the reimbursement rate to equal the rate of the real value of the energy provided to the grid.

To enroll in this system, qualifying customers with home solar systems smaller than 1 megawatt, pay for the one-time connection fee.

Other conditions are included in the D.22-12-056 and an overview can be accessed at the California Public Utilities Commission website.13, 14

Renewable Energy Credits (REC)

Renewable energy credits can be purchased by companies in the state and around the world to offset their emissions. Solar owners in CA are able to obtain RECs as compensation for power provided to the grid.

To apply for this very specific California solar incentive, solar system owners must register their generation equipment and system size with the Energy Commission and another approval body.15

The typical home installation would not make RECs a profitable venture, however, if you own land or have multiple sites on your property, this CA incentive could help you obtain a return on your investment sooner.

Income-Qualified Enrollment for CA Energy Efficiency Programs

California provides qualified programs to families and individuals who meet income-based requirements. Two such programs are the California Alternate Rates for Energy (CARE) and the Energy Savings Assistance Program (ESA).

If you qualify, utility providers deliver reduced energy rates from 20 to 35 percent, depending on the size of the utility provider.

Signing up for the CARE programs and checking income eligibility can be done by calling the following providers, who can help you understand how to claim solar tax credit in California and other rebates:16

| Utility Provider | Emergency Payment Contact Number |

| PG&E | 866-743-2273 |

| Edison | 866-675-6623 |

| SDG&E | 800-411-7343 |

| SoCalGas | 800-427-2200 |

| Alpine Nat’l Gas | 209-772-3006 |

| Bear Valley Elect | 800-808-2837 |

| PacifiCorp | 888-221-7070 |

| Liberty Utilities | 800-782-2506 |

| Southwest Gas | 877-860-6020 |

| West Coast Gas | 916-364-4100 |

The ESA program can pay for the replacement of:

- Appliances (furnaces, refrigerators)

- Insulation of water heaters and attics in dwellings

- Low-flow shower heads and weatherstripping, caulking, and other weatherization

- You can check your income eligibility and enroll in the program at the CPUC website.17

Cost of Installing Solar Panels in California

Depending on your location and a number of factors, the cost of installing solar panels in California varies. The average cost for a solar home energy system is 6 kilowatts (kW), approximately $17,500 in 2023.

However, once California solar incentives are applied, the amount can be significantly reduced, and even without local credits or area rebates, the end price for a green energy system for your home will be approximately $10,000.

Purchasing options are available to reduce this amount even further.

Power Purchase Agreements

California power purchase agreements work by allowing you to install your home solar panels and pay a reduced amount for your monthly electricity bills.

However, the solar array and system are owned by the provider and residents aren’t able to apply for any of the tax credits or rebates associated with the system.

Cash and Loan Options

Buying your solar system is the best way to speed up the return on your investment, but many residents find that solar loan programs provide the means for installing the green energy system immediately.

Although the interest rates on a solar loan will reduce your overall savings, this option can be effective since it allows you to purchase the system and take advantage of the rebates, credits, and other renewable energy programs associated with solar.

Moreover, there are many dedicated loan companies that specialize in California solar loans, offering low rates and 100 percent financing.

Residential Solar Checklist and Considerations

Before installing a home solar system in California, you’ll need to make sure that your roof and house situation will facilitate the system you want to install.

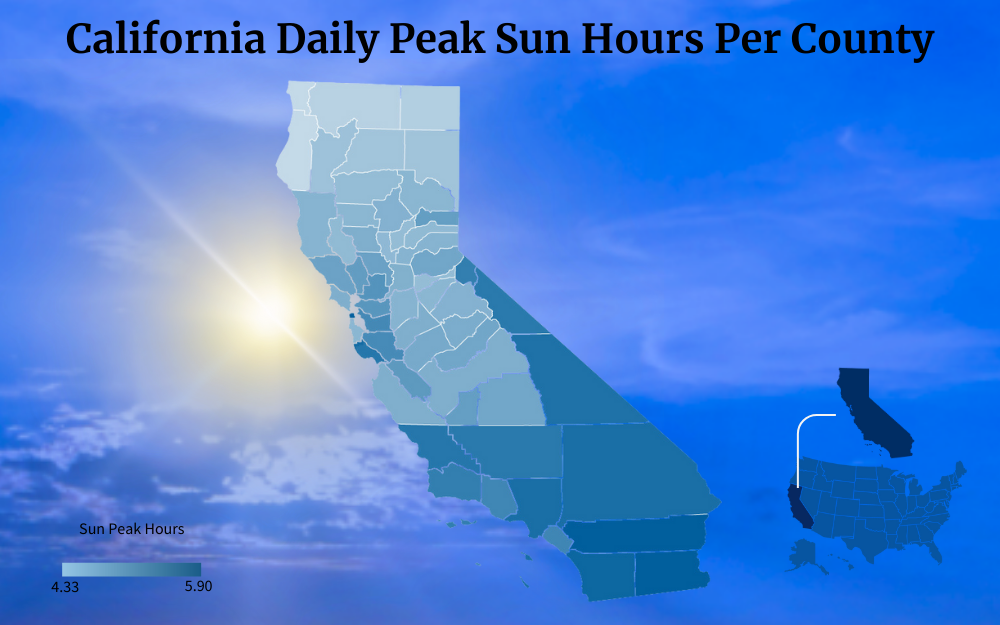

Roof Condition, Pitch, Location and Orientation

The pitch, condition, location, and orientation of your roof will play a large role in the cost of your solar panel system.

For example, flat roofs require specific solar panel mounting equipment and tracks, as opposed to a pitched roof, and roofs that are older than 30 years may need to be inspected to ensure that they are structurally sound to hold the weight of the solar panels.

The rules for rooftop installation are:

- Location determines the pitch of the solar panels: The latitude of your address indicates the angle degree the solar panels should be installed.

- Roof orientation: North and South orientation is best, maximizing the potential energy generation.

| Common Roof Pitch | Degree |

| 3/12 pitch | 14 degrees |

| 4/12 pitch | 18.4 degrees |

| 5/12 pitch | 22.6 degrees |

| 6/12 pitch | 26.6 degrees |

| 7/12 pitch | 30.3 degrees |

| 8/12 pitch | 33.7 degrees |

| 9/12 pitch | 36.9 degrees |

You can locate your latitude by doing a web search of your address. Many homes in the southern part of the state are at 35 degrees, while those further north are closer to 38 degrees.

To maximize the amount of energy your solar panels can generate, tracks and mounting equipment will be used.

However, most California solar incentives and federal tax credits and rebates include the cost of the materials (panels and mounting equipment) as well as storage (batteries) and installation.

Understanding how California solar incentives and renewable energy rebates, credits, and programs operate can significantly reduce the upfront costs involved with home solar energy system installation.

Frequently Asked Questions About California Solar Incentives

What Is Net Metering and How Does It Work To Reduce Energy Costs in CA?

Net metering in California is the process of sharing solar panel energy with the local utility grid provider in exchange for funds or reductions in other utility costs.

Does California Offer Power Purchasing Agreements?

Like many other states, California Power Purchasing Agreements are available, but it’s important to remember that these specific contracts don’t allow the resident to obtain the credits and rebates.

Can I Get Solar Panels Free in California?

California has a number of qualified programs that can be used to obtain free solar energy systems and solar panels, based on income.

References

1State of California . (2021). Electrical Energy and Energy Efficiency. California Public Utilities Commission. Retrieved September 21, 2023, from <https://www.cpuc.ca.gov/consumer-support/consumer-programs-and-services/electrical-energy-and-energy-efficiency>

2State of California . (2021). Electrical Energy and Energy Efficiency. California Public Utilities Commission. Retrieved September 21, 2023, from <https://www.cpuc.ca.gov/consumer-support/consumer-programs-and-services/electrical-energy-and-energy-efficiency>

3Office of Environmental Health Hazard Assessment. (2023). SB 535 Disadvantaged Communities. OEHHA. Retrieved September 21, 2023, from <https://oehha.ca.gov/calenviroscreen/sb535>

4GRID Alternatives. (2023). DAC-SASH. GRID Alternatives. Retrieved September 21, 2023, from <https://gridalternatives.org/what-we-do/program-administration/dac-sash>

5State of California. (2021). California Alternate Rates for Energy (CARE). California Public Utilities Commission. Retrieved September 21, 2023, from <https://www.cpuc.ca.gov/care/>

6State of California. (2021). Family Electric Rate Assistance Program (FERA). California Public Utilities Commission. Retrieved September 21, 2023, from <https://www.cpuc.ca.gov/consumer-support/financial-assistance-savings-and-discounts/family-electric-rate-assistance-program>

7State of California. (2020, July 23). BEFORE THE PUBLIC UTILITIES COMMISSION OF THE STATE OF CALIFORNIA. Retrieved September 21, 2023, from <https://docs.cpuc.ca.gov/PublishedDocs/Published/G000/M344/K058/344058812.PDF>

8State of California. (2021). Participating in Self-Generation Incentive Program (SGIP). California Public Utilities Commission. Retrieved September 21, 2023, from <https://www.cpuc.ca.gov/industries-and-topics/electrical-energy/demand-side-management/self-generation-incentive-program/participating-in-self-generation-incentive-program-sgip>

9Emery, A., & Lyon, E. (2023, July 27). Demand Side Grid Support (DSGS) Program Guidelines, Second Edition. California Energy Commission. Retrieved September 21, 2023, from <https://www.energy.ca.gov/publications/2023/demand-side-grid-support-dsgs-program-guidelines-second-edition>

10Olivine, Inc. (2023). Enrollment – Demand Side Grid Support. Olivine, Inc. Retrieved September 21, 2023, from <https://dsgs.olivineinc.com/enrollment/>

11Rancho Mirage Energy. (2023). Discounts/Rebates. Rancho Mirage Energy Authority. Retrieved September 21, 2023, from <https://ranchomirageenergy.org/billing-rates/discounts-rebates/>

12Sacramento Municipal Utility District. (2023). Battery storage for homeowners. SMUD. Retrieved September 21, 2023, from <https://www.smud.org/en/Going-Green/Battery-storage/Homeowner>

13State of California. (2022, December 19). Order Instituting Rulemaking to Revisit Net. State of California. Retrieved September 21, 2023, from <https://docs.cpuc.ca.gov/PublishedDocs/Published/G000/M500/K043/500043682.PDF>

14State of California. (2021). Net Energy Metering. California Public Utilities Commission. Retrieved September 21, 2023, from <https://www.cpuc.ca.gov/industries-and-topics/electrical-energy/demand-side-management/customer-generation>

15State of California. (2023). Renewables Portfolio Standard – Certification. California Energy Commission. Retrieved September 21, 2023, from <https://www.energy.ca.gov/programs-and-topics/programs/renewables-portfolio-standard/renewables-portfolio-standard-0>

16State of California. (2021). California Alternate Rates for Energy (CARE). California Public Utilities Commission. Retrieved September 21, 2023, from <https://www.cpuc.ca.gov/consumer-support/financial-assistance-savings-and-discounts/california-alternate-rates-for-energy>

17State of California. (2021). Energy Savings Assistance. California Public Utilities Commission. Retrieved September 21, 2023, from <https://www.cpuc.ca.gov/consumer-support/financial-assistance-savings-and-discounts/energy-savings-assistance>

18Internal Revenue Service. (2023). Residential Energy Credits. IRS. Retrieved September 21, 2023, from <https://www.irs.gov/pub/irs-pdf/f5695.pdf>

19Photo by SPG Solar. CC BY-SA 3.0. Resized and Changed Format. Wikimedia Commons. Retrieved from <https://commons.wikimedia.org/w/index.php?curid=74930051>